57+ when will the fed stop buying mortgage-backed securities

Web March 2 2023 237 PM 3 min read. Web As of January 25 the Fed held 2625 trillion in mortgage paper down from a recent peak of 2740 trillion in April so the reduction isnt happening at the pace the Fed.

The Latest Move By The Federal Reserve February 1 2023

This is not something the Fed is.

. Kathy Jones head of fixed income at Charles Schwab anticipates monthly cuts of 5. Web The unusually high spreads reflect a combination of uncertainty about the US. Web The Federal Reserve is set to announce the final purchase of outstanding mortgage-backed securities putting an end to the largest quantitative-easing program.

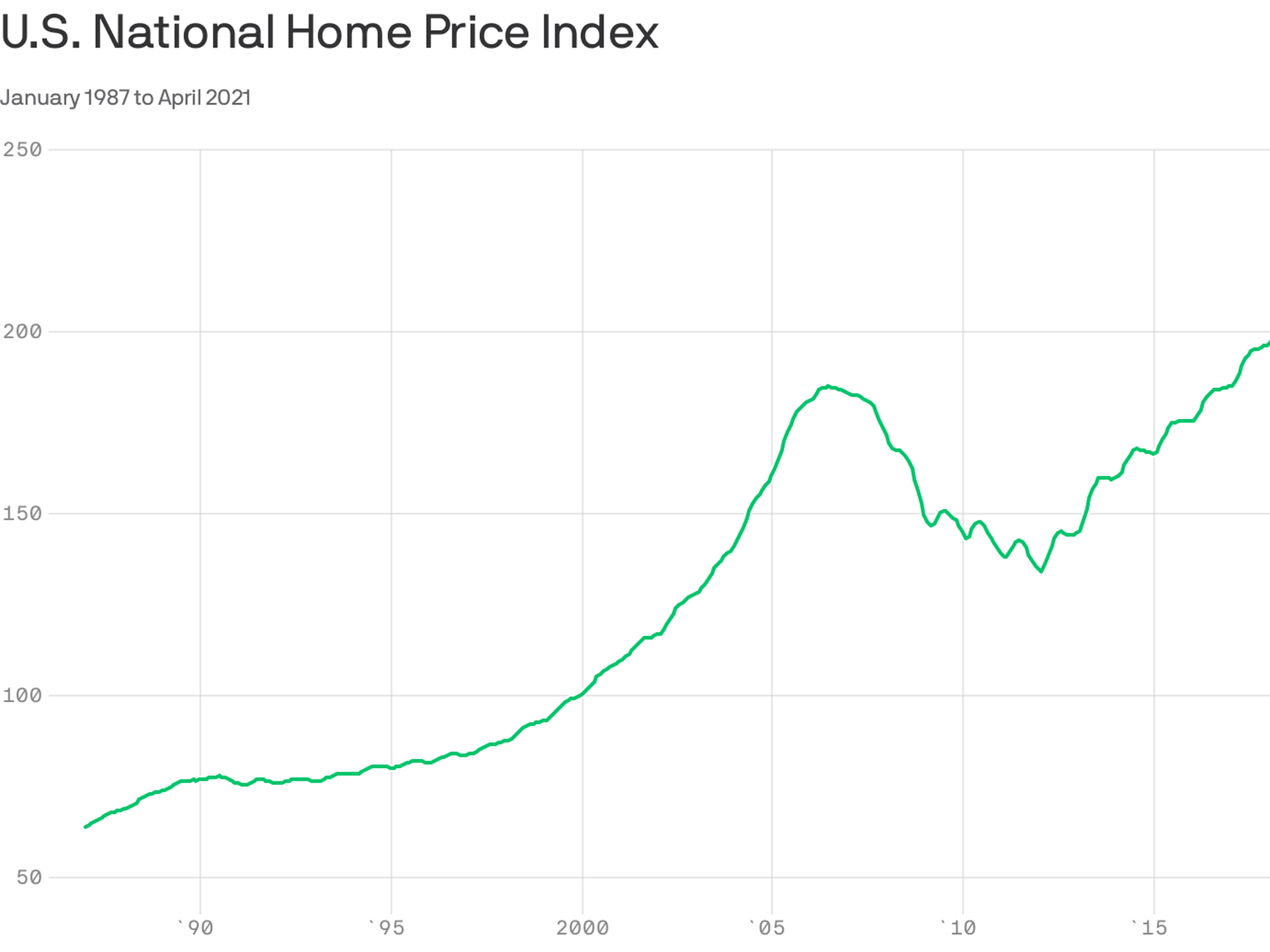

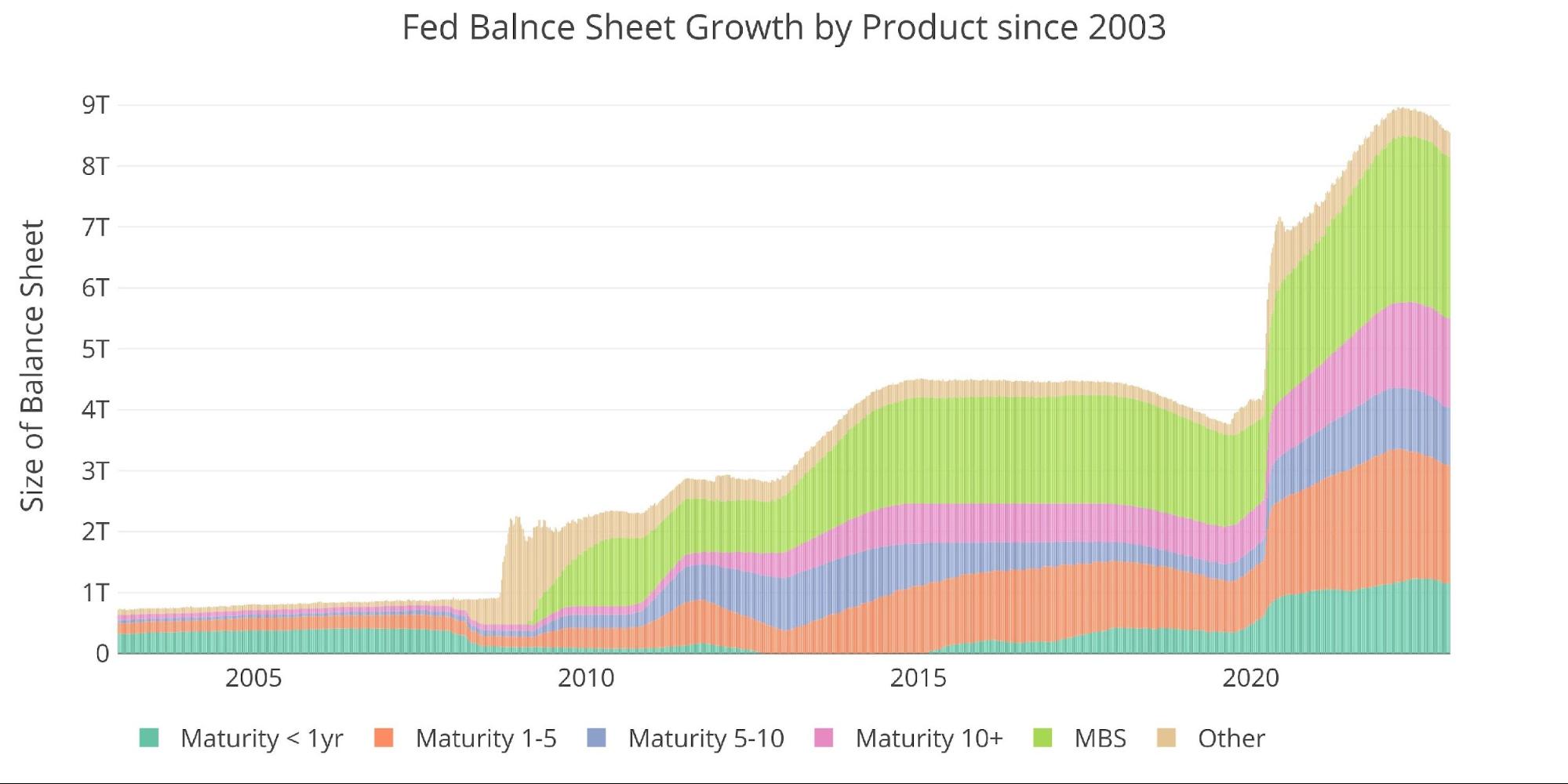

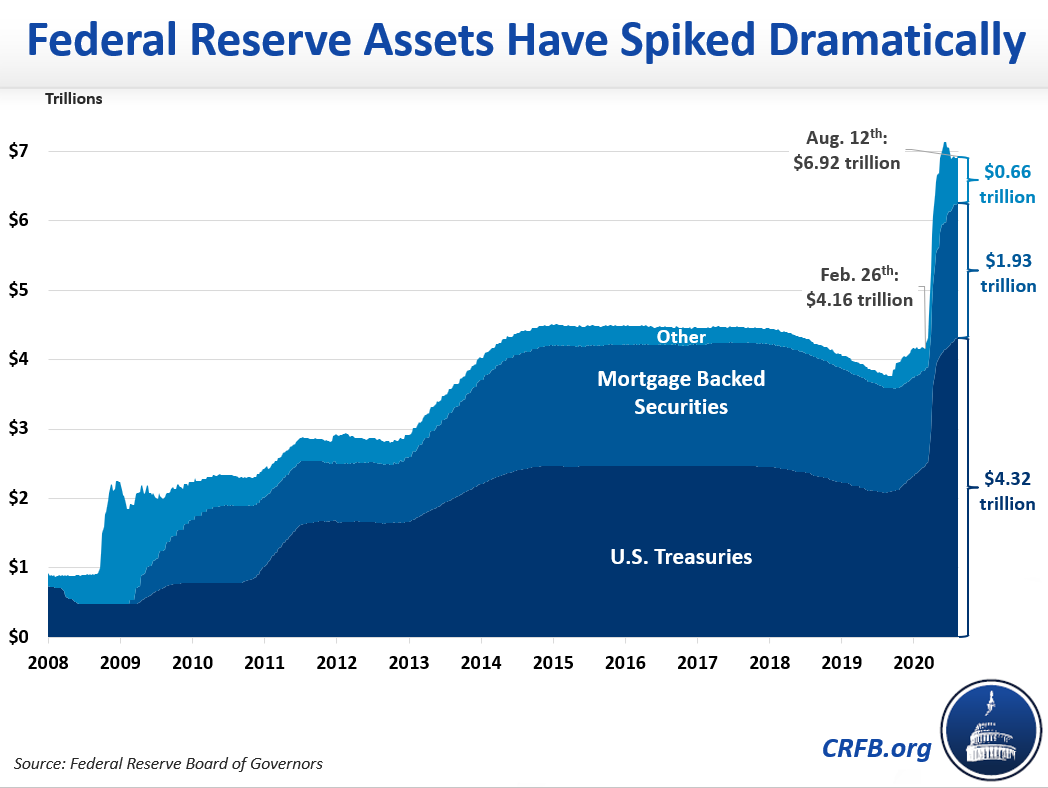

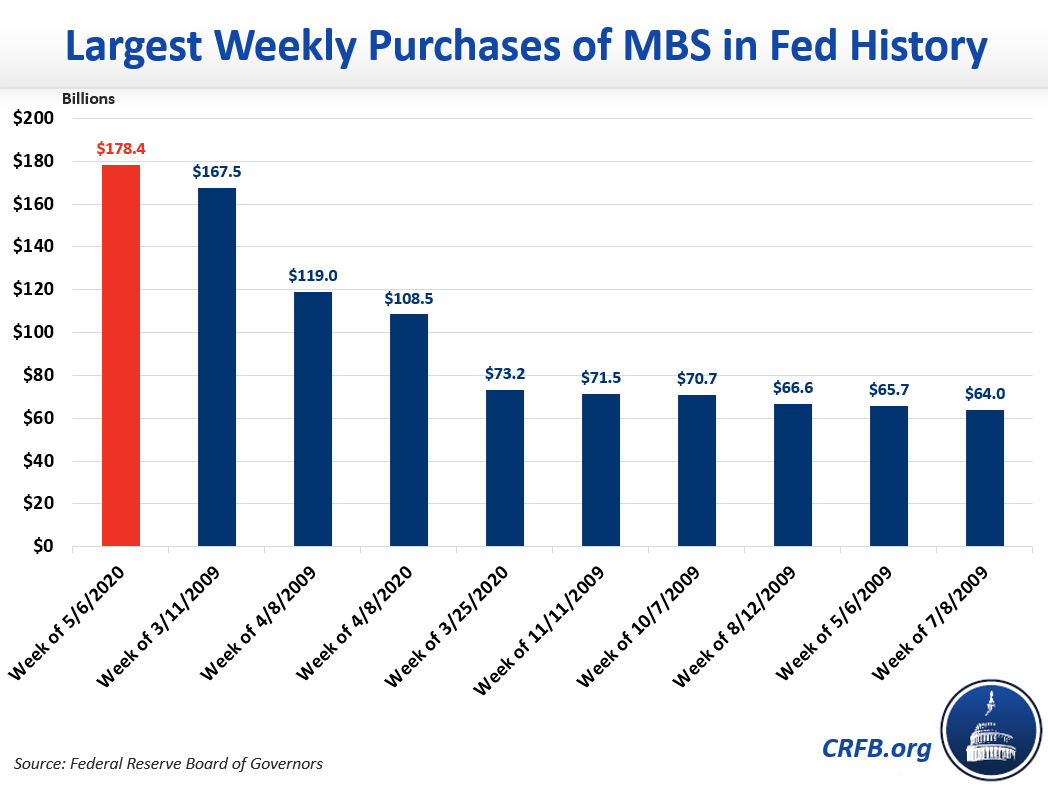

Web With home prices surging some Federal Reserve officials have made the case for the central bank to back out of the mortgage securities market. Web The Fed Should Get Out of the Mortgage Market Even central bankers are starting to wonder why theyre adding 40 billion of housing debt every month. Web Over that same period the Federal Reserve expanded its total portfolio from 920 billion in December 2007 to 21 trillion in June 2009 a total increase of 12 trillion.

Web The Feds presence in the bond markets an emergency measure to support the economy during the COVID-19 pandemic helped to keep credit flowing and put. Web Fed Buying Helps Lift Fannie Mae Mortgage Bond to Record High Coupon spread has tightened deep into negative territory The central bank has purchased over. Web When the Federal Reserve starts scaling back its massive bond-buying spree mortgage traders are betting their market will be at the forefront.

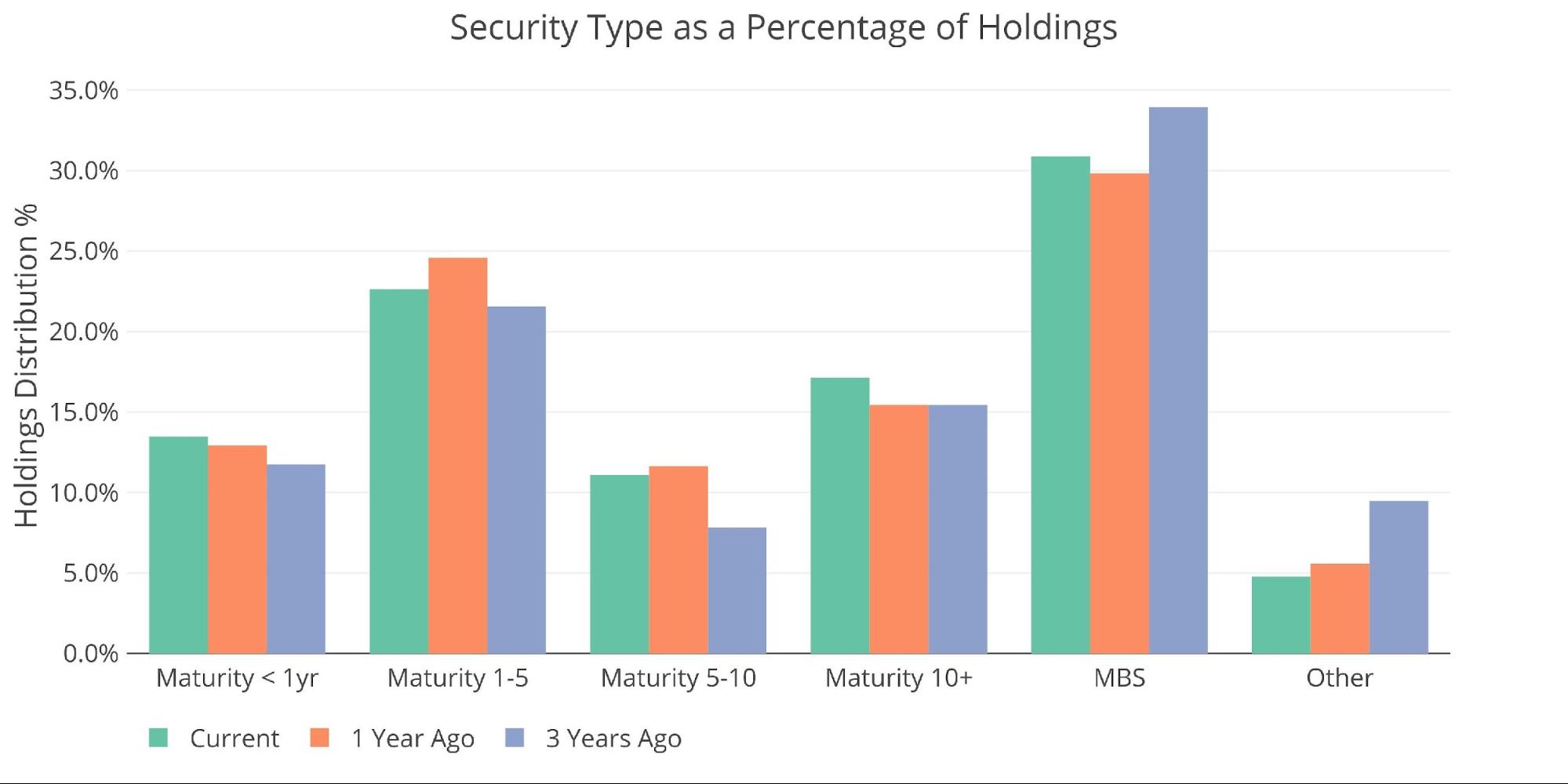

Web The Federal Reserve will continue to purchase Treasury securities and agency mortgage-backed securities in the amounts needed to support smooth market. Web The Fed says that by September it will reduce the mortgage portfolio by up to 35 billion per month. Web The Fed has bought 982 billion of the mortgage bonds since March 5 2020 and currently plans to keep buying at least 40 billion each month.

When they refer to agency MBS. Web The Federal Reserve is currently buying 40 billion worth of agency MBS every month in order to support the housing market. Bloomberg -- Federal Reserve Bank of Atlanta President Raphael Bostic said he still prefers to raise rates by another quarter.

Web Tapering might start in November or December and be finished by July 2022. Emphasis on up to In fact the numbers will probably. Web 19 hours agoThe big fear for the mortgage REITs has been the specter of the Fed selling off its portfolio of mortgage-backed securities.

Web Moreover the poll showed the median view of economists pointed to the Fed scaling back its buying of Treasuries and MBS at an initial pace of 10 billion each likely. Economy and the Feds decision to stop aggressively buying mortgage-backed. Sam Ro Axios July 1 2021 AP PhotoPatrick Semansky File The Fed has been purchasing 40 billion.

Web The Federal Reserve quickly responded to significant financial market disruption at the onset of the COVID-19 pandemic in March 2020 providing stability in a. Web What Would Happen If The Fed Stopped Buying Mortgages. That would be a.

The Fed Has Missed The Balance Sheet Mortgage Back Security Reduction Target Reduction Every Single Month Schiffgold

Fed Mortgage Backed Security Purchases Reached A New Record Committee For A Responsible Federal Budget

The Fed Has Missed The Balance Sheet Mortgage Back Security Reduction Target Reduction Every Single Month Schiffgold

The Fed Stopped Buying Mbs Today Wolf Street

Fed To Announce Final Purchase Of Mortgage Backed Securities

Will The Fed Really Sell Its Mortgage Bonds Next Year Financial Times

The Federal Reserve Will Begin Reducing Its Holdings Of Treasury Notes And Bonds

Fed Cut Back On Helicopter Money For Wall Street The Wealthy Wolf Street

Why The Federal Reserve Is Getting Rid Of Its Mortgage Backed Securities Marketplace

The Fed Has Missed The Balance Sheet Mortgage Back Security Reduction Target Reduction Every Single Month Schiffgold

The Fed Stopped Buying Mbs Today Wolf Street

Fed S Biggest Ever Bond Buying Binge Is Drawing To A Close Bloomberg

The Fed Has Missed The Balance Sheet Mortgage Back Security Reduction Target Reduction Every Single Month Schiffgold

Fed Mortgage Backed Security Purchases Reached A New Record Committee For A Responsible Federal Budget

Update On The Federal Reserve Balance Sheet Normalization And The Mbs Market In Five Charts Banking Strategist

The Fed Stopped Buying Mbs Today Wolf Street

Will The Fed Really Sell Its Mortgage Bonds Next Year Financial Times